|

Special Features

Image Libraries

|

|

Blog

Here we are. Donald Trump is America's president. The largest protest in American history greeted his first day. Welcome to Washington and the USA in 2017.

Saturday’s Women’s March. Image from Mobilus In Mobili on Flickr.

Our weekend was momentous

Two days, two gigantic events.

As inaugurations go, Friday's was noticably small. But even a small inauguration is big enough to change the tone of city life.

Security fences partitioned blocks of downtown, and an army of police forces dominated the streets. Many locals stayed away to avoid the logistical and emotional headaches. Parts of the city became eerily dead, while others burst with unusual life, as Trump supporters descended to hotels and tourist areas around the White House.

Washington became a foreign city, its own residents outsiders to a security and tourist project to which we didn't belong, nor feel healthy within.

Security barriers in an empty downtown.

During the inauguration itself, Metro ran smoothly. Trump presented a bleak picture of America. Protests raged, mostly peacefully, sometimes not. GGWash's own David Whitehead proved that deescalation works.

The new administration erased climate change from presidential priorities, and disciplined the National Park Service for reporting meager crowds. Joe Biden took Acela home to Delaware.

We went to bed, unsure the country we would wake to find.

And then, on Saturday, three times more people attended the Women's March than Friday's inauguration. Nationwide, at least three million took to the streets.

There was grief and humor and defiance. Mayor Bowser chanted "Leave us alone!, " DC police donned pink hats, and Metro had its second busiest day ever.

In contrast to Friday, Saturday's Washington felt more ours than ever. The city became strangely joyous, as march-goers spread over downtown and the National Mall to reclaim our public spaces, replacing the inauguration's fenced-off security apparatus with revelry lasting well into the evening.

We went to bed with renewed determination.

Image from Andrew Aliferis on Flickr.

Meanwhile, Donald Trump's press secretary brazenly lied, and his counselor hoped to replace the truth with "alternative facts" intended to sow uncertainty and estrange the media.

The policy fights are just beginning

Trump may be the most urban president in history, but his party and his base are vehemently anti-urban. Administration policy seems to be largely under the purview of Vice President Pence, whose small town Indiana roots are decidedly not urban.

They plan dramatic cuts to many federal departments, including the Department of Transportation, where multimodal infrastructure spending will likely decline in favor of tax breaks for construction firms. The Environmental Protection Agency is likely to be gutted, enabling a new round of urban pollution and ending the fight against climate change. HUD raised prices for first-time homebuyers within an hour of Trump's swearing-in. The Department of Justice will no longer pressure police departments over civil rights.

What will the EPA look like in four years? Image from Paul Fagan on Flickr.

Locally, such massive cuts and a proposal to strip benefits from government employees could throw Washington's economy into recession, as jobs bleed out of the city. Or security and military spending could lead to a new boom. Either way, Congress' small government Republicans will override local decision-making in DC.

Nationally, the right is emboldened, while the left is beginning to act like a true opposition.

So, here we are. Donald Trump is America's president. The future of our city and our country is uncertain. We face colossal challenges. But GGWash's mission and values are still worthwhile, and our community is as strong as ever. We'll be here.

Comment on this at the version cross-posted to Greater Greater Washington. Comment on this at the version cross-posted to Greater Greater Washington.

Average Rating: 4.6 out of 5 based on 257 user reviews.

January 23rd, 2017 | Permalink

Tags: economy, environment, events, government, in general, metrorail, The New America, transportation

According to the California housing champion who’s suing communities that don’t allow enough new development, not building needed density is morally equivalent to tearing down people’s houses.

Photo by .Martin. on Flickr.

Sonja Trauss, founder of the SF Bay Area Renters’ Federation sums up the housing problem affecting nearly every growing American city today:

“Most people would be very uncomfortable tearing down 315 houses. But they don’t have a similar objection to never building them in the first place, even though I feel they’re morally equivalent. Those people show up anyway. They get born anyway. They get a job in the area anyway. What do they do? They live in an overcrowded situation, they pay too much rent, they have a commute that’s too long. Or maybe they outbid someone else, and someone else is displaced.”

Trauss hits the key points: The population is growing, and people have to live somewhere. If we refuse to allow them a place to live, that’s just like tearing down someone’s home.

Someone else is displaced

Trauss’ last sentence is particularly important. It explains how the victims of inadequate housing often are not even part of the discussion. She says “Or maybe [home buyers] outbid someone else, and someone else is displaced.”

Here’s how that works: One common argument among anti-development activists is that new development only benefits the wealthy people who can afford new homes. That’s wrong. It’s never the wealthy who are squeezed out by a lack of housing. Affluent people have options; they simply spend their money on the next best thing. Whenever there’s not enough of anything to meet demand, it’s the bottom of the market that ultimately loses out.

Stopping or reducing the density of any individual development doesn’t stop displacement or gentrification. It merely moves it, forcing some other person to live with its consequences.

Every time anti-development activists in Dupont or Georgetown or Capitol Hill reduce the density of a construction project, they take away a less-affluent person’s home East of the River, or in Maryland, or somewhere else. The wealthy person who would have lived in Capitol Hill instead moves to Kingman Park, the middle class person who would have lived in that Kingman Park home instead moves to Carver Langston, and the long-time renter in Carver Langston gets screwed.

As long as the population is growing, the only ultimate region-wide solution is to enact laws that allow enough development to accommodate demand.

Comment on this at the version cross-posted to Greater Greater Washington. Comment on this at the version cross-posted to Greater Greater Washington.

Average Rating: 4.4 out of 5 based on 183 user reviews.

January 5th, 2016 | Permalink

Tags: development, economy, environment, law, preservation

A miniature Target is now open in Rosslyn, occupying the ground floor of an office tower. At less than a sixth the size of a typical suburban Target, it shows how retailers are adapting to America’s increasingly urban reality.

Inside Rosslyn’s Target.

The store had a soft opening last week, and an official opening Sunday. At 23, 000 square feet, it’s about the size of a large Trader Joe’s, or a small Safeway. It’s minuscule compared to normal Target stores, which often top 150, 000 square feet.

And yet, it’s got a little of everything, just like a normal Target.

Inside Rosslyn’s Target.

A few years ago, when I lived in a Ballston high rise, I’d have killed to have a Target on the Orange Line. The only department stores I had easy access to were the Macy’s in Ballston and downtown DC. And, for a recent college grad spending way too much on housing, Macy’s wasn’t in my budget for housewares.

Now urban department stores are sprouting everywhere.

Rosslyn’s Target, from Wilson Boulevard.

This is, by my count, at least the Washington region’s fourth fifth urban-format Target. The first opened in the 1990s in Gaithersburg. Then came Columbia Heights in 2008 and Merrifield in 2012, then our first mini Target earlier this year in College Park.

Walmart joined the game beginning in late 2013, with urban stores downtown and on Georgia Avenue.

Smaller stores may be the new normal

It’s not just Target and Walmart looking to get in on this game. Other chains are launching a new breed of mid-size stores, like this mini Target, in a race to fill the urban retail niche.

In 2013, Walgreens opened a new “flagship” store in Chinatown. At 23, 000 square feet, it’s almost exactly the same size as the new Rosslyn Target, and twice a normal Walgreens.

The flagship Walgreens. Photo from Google.

And although their merchandise selections are a little different (the Target has more clothes and housewares, while the Walgreens has more beauty & health products), the Rosslyn Target and the Chinatown Walgreens are clearly evolving towards becoming a similar category of store: The not-quite-department-store, or the 21st Century general store.

Whatever you call it, it’s a growing retail niche.

Comment on this at the version cross-posted to Greater Greater Washington. Comment on this at the version cross-posted to Greater Greater Washington.

Average Rating: 4.4 out of 5 based on 205 user reviews.

October 12th, 2015 | Permalink

Tags: development, economy, The New America

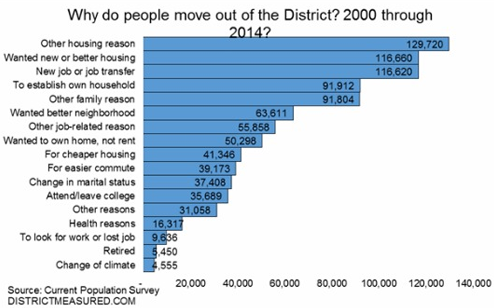

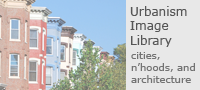

DC’s population is rising overall. But amid that rise, hundreds of thousands of people have come or gone since the year 2000. Among those who have left, inadequate housing is by far the biggest single reason.

Image from the DC Office of Revenue Analysis.

According to survey data summarized in this report from the DC Office of Revenue Analysis, 937, 115 people have moved out of DC since the year 2000. 36% of them, 338, 000, cite a housing-related category as the reason why.

Some respondents say directly they needed cheaper housing. Others say they wanted newer housing, or better housing, or to own instead of rent. But the common denominator is that DC’s housing stock is inadequate, and that inadequacy is stifling the District’s population growth, as thousands who’d otherwise prefer to stay move away.

Every time some government agency restricts the housing market’s ability to meet DC’s tremendous demand, they make this problem worse. Every time the zoning commission downzones rowhouse neighborhoods, or every time a review board lowers a proposed building’s height, DC’s housing market becomes a little bit worse than necessary.

Over time as each restriction builds on the last, competition for the limited housing that’s available rises, prices shoot up, and the city’s less affluent populations are squeezed out.

It’s true that DC can never be all things to all people. For example, DC will never be able to supply as many large lot subdivisions as upper Montgomery County. But many types of housing that DC can absolutely supply are being unnaturally and unnecessarily restricted.

It’s a horrible situation.

What about schools?

DC’s inadequate schools are without a doubt also a major reason some people leave the District. According to Yesim Sayin Taylor of the Office of Revenue Analysis, we don’t know how many residents have left because of schools because the survey, which wasn’t designed specifically for DC, didn’t ask that question.

Presumably respondents who left because of schools cited something more general like “other family reason” or “wanted better neighborhood.”

Cross-posted at Greater Greater Washington. Cross-posted at Greater Greater Washington.

Average Rating: 4.9 out of 5 based on 292 user reviews.

June 12th, 2015 | Permalink

Tags: demographics, development, economy, government, law, preservation

|

Photo by Wil C. Fry on Flickr. |

Gas prices have fallen below $3 per gallon in much of the US, and the explanation isn’t the simple seasonal differences that always make gas cheaper in autumn. The bigger reason: US oil shale deposits are turning the global oil market on its head.

How did cheap gas happen?

In the simplest terms, supply is up and demand is down.

Travel drops between the summer travel season and the holidays, and cooler fall temperatures actually make gas cheaper to produce. That’s why gas prices always fall in autumn.

But that’s not enough to explain this autumn’s decline, since gas hasn’t dropped this low in years. China is also using less gas than expected, but that’s also only part of the explanation.

The bigger explanation seems to be that supply is also up, in a huge way. North American oil shale is hitting the market like never before, and it’s totally unbalancing the global oil market. Oil shale has become so cheap, and North American shale producers are making such a dent in traditional crude, that some prognosticators are proclaiming that “OPEC is over.”

It’s that serious a shift in the market.

Will this last?

Yes and no.

The annual fall price drop will end by Thanksgiving, just like it always does. Next summer, prices will rise just like they always do. Those dynamics haven’t changed at all.

Likewise, gasoline demand in China and the rest of the developing world will certainly continue to grow. Whether it outpaces or under-performs predictions matters less in the long term than the fact that it will keep rising. That hasn’t changed either.

But the supply issue has definitely changed. Oil shale is here to stay, at least for a while. Oil shale production might keep rising or it might stabilize, but either way OPEC crude is no longer the only game in town.

Of course, oil shale herf=”http://www.businessweek.com/articles/2013-10-10/u-dot-s-dot-shale-oil-boom-may-not-last-as-fracking-wells-lack-staying-power”>isn’t limitless. Eventually shale will hit peak production just like crude did. When that happens it will inevitably become more expensive as we use up the easy to refine reserves and have to fall back on more expensive sources. That’s a mathematical certainty. But it’s not going to happen tomorrow. In the meantime, oil shale isn’t very scarce.

So the bottom line is that demand will go back up in a matter of weeks, and the supply will probably stabilize, but at higher levels than before.

What does this mean?

Here’s what it doesn’t mean: There’s never going to be another 1990s bonanza of $1/gallon fill-ups. Gas will be cheaper than it was in 2013, but the 20th Century gravy train of truly cheap oil is over.

Oil shale costs more to extract and refine than crude oil. Prices have to be high simply to make refining oil shale worth the cost, which is why we’ve only recently started refining it at large scales. Shale wouldn’t be profitable if prices dropped to 1990s levels. In that sense, oil shale is sort of like HOT lanes on a congested highway, which only provide benefits if the main road remains congested.

So shale can only take gas prices down to a little below current levels. And eventually increased demand will inevitably overwhelm the new supply. How long that will take is anybody’s guess.

In the ultimate long term, oil shale doesn’t change most of the big questions surrounding sustainable energy. Prices are still going to rise, except for occasional blips. We still need better sustainable alternatives. Fossil fuels are still wreaking environmental catastrophe, and the fracking process that’s necessary to produce oil shale is particularly bad. It would be foolish in the extreme for our civilization to abandon the progress we’ve made on those fronts, and go back to the SUV culture of the 20th Century.

There will probably be lasting effects on OPEC economies. The geopolitical situation could become more interesting.

In the meantime, enjoy the windfall.

Cross-posted at Greater Greater Washington. Cross-posted at Greater Greater Washington.

Average Rating: 4.4 out of 5 based on 248 user reviews.

October 28th, 2014 | Permalink

Tags: economy, energy, environment, roads/cars, transportation

Walmart’s foray into urban format stores officially begins today, with stores on H Street and Georgia Avenue opening for business. The H Street store marks the first time in 18 years DC has had two downtown department stores.

I stopped by the downtown store and snapped a few pictures.

|

|

| H Street Walmart. |

The main entrance leads into a small ground floor lobby. The actual store is one floor up. I was surprised to discover that aside from the lobby, the whole store is a single level.

> Continue reading

Average Rating: 4.6 out of 5 based on 169 user reviews.

December 4th, 2013 | Permalink

Tags: development, economy

|

This doesn’t make money either.

Photo by \Ryan on flickr. |

Why do cities keep building stadiums, despite study after study showing they don’t make money? Simple: They’re cultural amenities that people want, and are willing to pay for.

When Mayor Gray announced the DC United stadium deal last month, he kicked off a public debate about stadium-building. Much of the debate has focused on whether or not the deal will make DC any money.

The fact that stadiums often lose money is largely irrelevant. So do museums, libraries, and opera houses. Stadiums fall into the same category.

Smart communities try to squeeze some economic development out of stadium deals, because they may as well, but that’s always a side benefit. At the end of the day it isn’t the main reason cities build stadiums.

It’s true that the privately-owned sports franchises that use stadiums reap a disproportionate benefit from public financing deals, but that’s also irrelevant to the stadium-building decision. Pro sports franchises are also cultural amenities that lots of people want and will pay for.

This is why decades of policy wonk hand-wringing over the money has rarely convinced anyone to stop building stadiums. That criticism, true as it is, simply does not invalidate the perceived benefit.

Cross-posted at Greater Greater Washington. Cross-posted at Greater Greater Washington.

Average Rating: 4.4 out of 5 based on 192 user reviews.

August 6th, 2013 | Permalink

Tags: development, economy, government

|

T-Mobile store. Image from T-Mobile. |

Someone has proposed a moratorium on liquor licenses in the U Street area. It seems unlikely to pass, but regardless, here’s a partial list of things I’d rather ban proliferation of in DC:

- Bank branches. In the age of ATMs, banks are offices, not retail. They have a deadening effect on sidewalk life and drive up the cost of retail space for everyone else.

- Cell phone stores. Proliferation of luxurious cell phone stores is proof that we’re all paying way too much for cell phone service.

- Pharmacies. Unlike cell phone stores, it is an important convenience for every neighborhood to have a CVS or Wallgreens. But after the 3rd one opens in your neighborhood, are you really excited about a 4th?

- Froyo stores. I like froyo, but it’s obviously a bubble that’s about to burst. No way can so many survive long term.

- Empty storefronts. Griping above notwithstanding, we shouldn’t ban anything as long as we have empty storefronts. Even that bank branch is better for sidewalk life than nothing.

Average Rating: 4.4 out of 5 based on 182 user reviews.

February 11th, 2013 | Permalink

Tags: economy, law

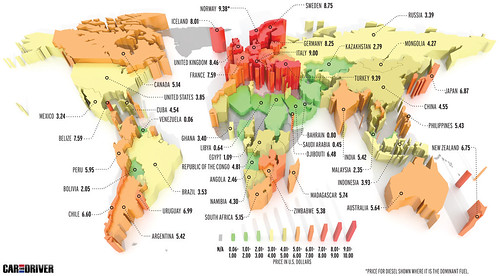

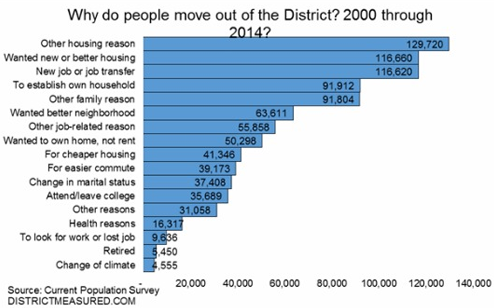

According to an international survey, the price of gasoline in the United States is still lower than in most of the rest of the world’s developed countries. The survey, by Car and Driver magazine, included this handy map showing the average price of 1 gallon of gas in US dollars for most of the world:

Average Rating: 4.7 out of 5 based on 257 user reviews.

January 7th, 2013 | Permalink

Tags: economy, energy, roads/cars, transportation

|

Alexandria’s proposed Hoffman Towers. Image by DCS Architects.

North Bethesda Market II, soon to be the tallest building in the Maryland suburbs. Image from JBG.

Reston’s next tallest building. Image from RTC Partnership. |

Within the confines of the District of Columbia, the question of whether to allow tall buildings is a subject of much debate. But in the burgeoning urban centers of Northern Virginia and suburban Maryland, there is no question: more tall buildings are coming.

For many decades Rosslyn has been home to the tallest skyscrapers in the Washington region. The taller of its Twin Towers is 381 feet tall. But soon that building will rank no better than 3rd tallest in Rosslyn alone, with the 384 foot tall 1812 North Moore and the 387 foot tall Central Place in construction or soon to begin.

Even with those new buildings, Rosslyn could soon lose its crown. Buildings as tall as 396 feet could soon be built around the Eisenhower Metro station in Alexandria. They would eclipse Alexandria’s current tallest building, the 338 foot tall Mark Center Hilton.

Tysons Corner is in on the action too. It’s tallest buildings right now are the 254 foot Ritz Carlton and the 253 foot 1850 Towers Crescent. But at 365 feet, a building in the proposed Scotts Run Station development will soon dominate.

In Maryland, North Bethesda Market I topped out last year at 289 feet tall, beating out Gaithersburg’s 275 foot tall Washingtonian Tower and thus becoming Montgomery County’s new tallest skyscraper. Its reign will be short-lived, as a new 300 foot tall ziggurat has already been proposed nearby.

And this week, big news is coming to Reston and Crystal City.

Yesterday Fairfax County approved a 330 foot building in Reston that will become the tallest building in the Reston Town Center cluster.

Meanwhile, the Arlington County Board is scheduled to vote this coming weekend to either approve or deny a 297 foot building in Crystal City that would tower well above all its neighbors. Tall buildings have long been constrained there by restrictions due to Reagan National Airport, but those rules recently changed, so taller buildings are now allowed.

By the standards of large central cities these aren’t particularly tall buildings. Baltimore and Virginia Beach both have buildings over 500 feet tall, and the world’s current record holder is a whopping 2, 717 feet. But still, the trend in the DC area is unmistakable; buildings are getting taller, and will most likely continue to do so.

Cross-posted at Greater Greater Washington. Cross-posted at Greater Greater Washington.

Average Rating: 5 out of 5 based on 236 user reviews.

September 13th, 2012 | Permalink

Tags: architecture, development, economy, urbandesign

|

Media

Site

About BeyondDC

Archive 2003-06

Contact

Category Tags:

Partners

|

Comment on this at the version cross-posted to Greater Greater Washington.

Comment on this at the version cross-posted to Greater Greater Washington.